About Franklin P. Sparkman CPATax Preparation, Accountant, CPAFranklin P. Sparkman has more than 26 years of experience working with clients in the Lancaster area. Attention to detail and dedication to every client is part of what makes our service a notch better than all the rest. Small business owners and large corporations continue to benefit from our wide variety of business accounting services. Bookkeeping, payroll services and business accounting have never been as easy or as efficient as it is when you go with Franklin P. Sparkman. Tax Preparation Charlotte North Carolina Accountant Charlotte North Carolina CPA Charlotte North Carolina Tax Preparation Lancaster South Carolina Accountant Lancaster South Carolina CPA Lancaster South Carolina More About Us NC & SC Tax Forms Waxhaw Office 704-315-6700 604 old Providence Rd, Waxhaw, NC 28173 Lancaster Office 803-286-8469 300 N Catawba St, Lancaster, SC 29721 When taking money out of a business, transactions must be carefully structured to avoid unwanted tax consequences or damage to the business entity. Business owners should follow the advice of a tax professional to make sure financial transactions are controlled and do not cause unanticipated taxation or other negative effects. For example, a shareholder of a... Read these tips for taxpayers who receive an IRS notice Receiving a notice from the Internal Revenue Service is usually no cause for alarm. Every year the IRS sends millions of letters and notices to taxpayers. In the event one shows up in the mailbox, here are ten things you should know.

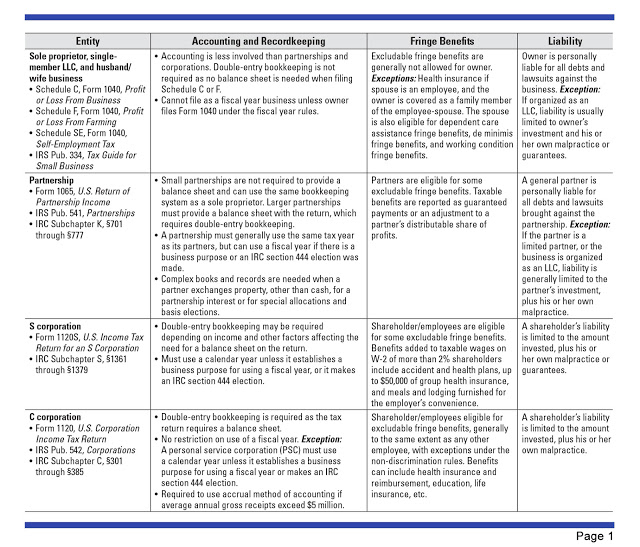

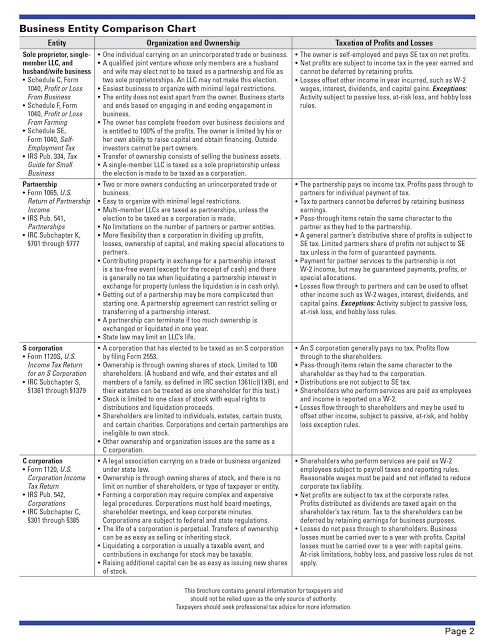

Intermingling FundsA common problem with single-owner and other closely-held corporations is intermingling of funds. This occurs when a corporate shareholder uses his or her personal checking account for corporate deposits or payment of corporate expenses. Separation of funds can be a... Tips for Newlyweds Updating your status from single to married may bring about some unanticipated changes, including changes relating to your taxes. While wedding planners don’t typically use an IRS checklist, here are a few things to keep in mind when filing your first tax return as a married couple. As with any tax issue, contact your tax professional to help you navigate your own unique situation. Reporting Property Repairs vs. Property Improvements Internal Revenue Code section 162 generally allows a current business deduction for the cost of repairs and maintenance incurred during the year. On the other hand, Internal Revenue Code section 263 requires the capitalization of amounts paid to acquire, produce, or improve tangible property. Since repairs and improvements often have very similar characteristics, it can be tricky to classify the expenditures. However, correct classification is important because the cost of repairs can generally be deducted in the year paid, while improvements must be capitalized and the deduction taken over several years through depreciation. An improvement requiring capitalization occurs with an.... Custodial Accounts (UTMA/UGMA)Assets in a custodial account belong to the minor. A custodian, usually an adult relative, controls the assets until the minor reaches the age set by... Accounting and Recordkeeping - Fringe Benefits - Liability Organization and Ownership - Taxation of Profits and Losses Business accounting and tax preparation is a dreadful task for most Carolina business owners. Thankfully, in... If you pay tuition, fees, and other costs for attendance at an eligible educational institution for yourself, your spouse, or your dependent, you may be able to take advantage of one or more of the education tax benefits. You can claim more than one education benefit in...

When taking money out of a business, transactions must be carefully structured to avoid unwanted tax consequences or damage to the business entity. Business owners should follow the advice of a tax professional to make sure financial transactions are controlled and do not cause unanticipated taxation or other negative effects. For example, a shareholder of a corporation can make a loan to... Read these tips for taxpayers who receive an IRS notice. Receiving a notice from the Internal Revenue Service is usually no cause for alarm. Every year the IRS sends millions of letters and notices to taxpayers. In the event one shows up in the mailbox, here are ten things you should know.

Intermingling Funds A common problem with single-owner and other closely-held corporations is intermingling of funds. This occurs when a corporate shareholder uses his or her personal checking account for corporate deposits or payment of corporate expenses. Separation of funds can be a key in preserving the liability protection of... College Financial Aid Planning Individuals who want to attend college but cannot afford the costs outright must find alternative funding through various types of financial aid. Many factors affect eligibility for... Reporting Property Repairs vs. Property Improvements Internal Revenue Code section 162 generally allows a current business deduction for the cost of repairs and maintenance incurred during the year. On the... Tips for Newlyweds Updating your status from single to married may bring about some unanticipated changes, including changes relating to your taxes. While wedding planners don’t typically use an IRS checklist, here are a few things to keep in mind when filing your first tax return as a married couple. As with any tax issue, contact your tax professional to help you navigate your own unique situation. Notify the Social Security Administration (SSA) If one of you has... Custodial Accounts (UTMA/UGMA) Assets in a custodial account belong to the minor. A custodian, usually an adult relative, controls the assets until the minor reaches the age set by state law (21 in most states). Assets in a custodial account can be used to... Business accounting and tax preparation is a dreadful task for most Carolina business owners. Thankfully, in your time of need there is a professional you can... Employee or Independent Contractor? In order for a business owner to know how to treat payments made to workers for services, he or she must first know the business relationship that exists between the business and the person performing the... When taking money out of a business, transactions must be carefully structured to avoid unwanted tax consequences or damage to the business entity. Business owners should follow the advice of a tax professional to make sure financial transactions are controlled and do not cause unanticipated taxation or other negative effects. For example, a shareholder of a... Read these tips for taxpayers who receive an IRS notice. Receiving a notice from the Internal Revenue Service is usually no cause for alarm. Every year the IRS sends millions of letters and notices to taxpayers. In the event one shows up in the mailbox, here are ten things you should know. 1. Don’t panic. Many of these letters can be dealt with... A common problem with single-owner and other closely-held corporations is intermingling of funds. This occurs when a corporate shareholder uses his or her personal checking account for corporate deposits or payment of corporate expenses. Separation of funds can... College Financial Aid Planning Individuals who want to attend college but cannot afford the costs outright must find alternative funding through various types of financial aid. Many factors affect eligibility for federal financial aid; therefore, all students should apply for financial aid every year even if they think they do not otherwise qualify. FAFSA. The Free Application for Federal Student Aid (FAFSA) is the first step in... Reporting Property Repairs vs. Property Improvements Internal Revenue Code section 162 generally allows a current business deduction for the cost of repairs and maintenance incurred during the year. On the other hand, Internal Revenue Code section 263 requires the capitalization of amounts paid to acquire, produce, or... Assets in a custodial account belong to the minor. A custodian, usually an adult relative, controls the assets until the minor reaches the age set by... Business accounting and tax preparation is a dreadful task for most Carolina business owners. Thankfully, in your time of need there is a professional you can trust to turn to for assistance. That professional is... |

Franklin P. Sparkman CPA

Serving The Charlotte Metro Area Since 1992; you can trust the experience and long standing reputation of Franklin P. Sparkman. Click here to learn more about our business. Archives

May 2021

Categories |

RSS Feed

RSS Feed